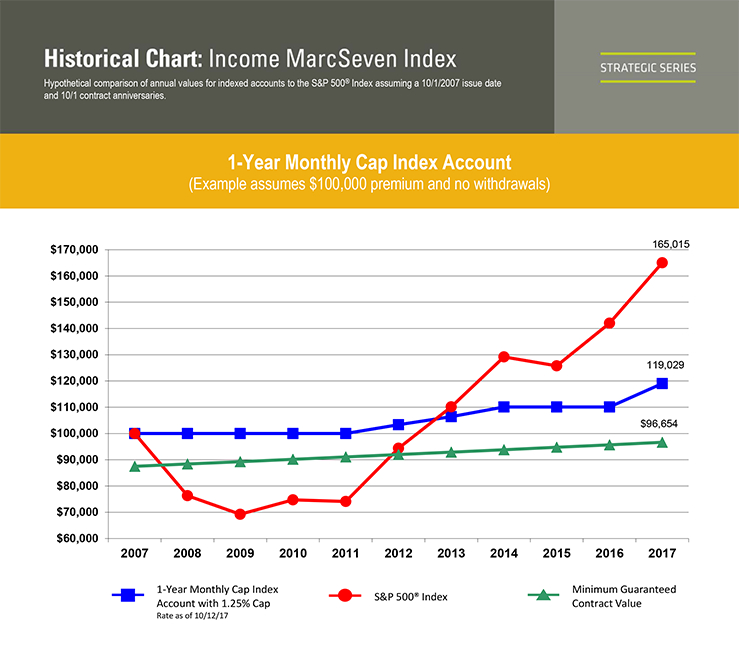

1-Year Monthly Cap Index Account

Index credits are based on the capped cumulative monthly changes in the S&P 500® Index for the policy year. The monthly cap rate is the upper-limit imposed on the change in the index on a monthly basis. There is no floor imposed on a negative change in the index on a monthly basis. The date of each monthly index value used is the date of your policy anniversary.

The percentage change in the index from month to month, adjusted for the monthly cap, is tracked. At the end of the policy year (your policy anniversary date), the sum of the monthly percentage changes in the index, adjusted for the monthly cap, is credited to your policy’s Accumulation Value.

The cap rate may be reset annually at the beginning of each policy year at the discretion of EquiTrust, but can never be less than the guaranteed minimum monthly cap rate.

Index credits for any crediting period can only be positive, or zero. Once added to your Accumulation Value, index credits are locked in. If the index is down for the year, the credited amount is zero. If index values decline in later years, any index credits previously added cannot be lost. However, policy expense charges, cost-of-insurance rates and policy fees can reduce your Accumulation Value.

The S&P 500® Index is a product of S&P Dow Jones Indices, LLC. (“S&P DJI”) and has been licensed for use by EquiTrust Life Insurance Company. S&P® and S&P 500® are registered trademarks of Standard & Poor’s Financial Services, LLC. (“S&P”). These trademarks have been licensed for use by S&P DJI and sublicensed for certain purposes by EquiTrust Life Insurance Company. EquiTrust index annuities are not sponsored, endorsed, sold or promoted by S&P DJI, S&P, or any of their respective affiliates or third party licensors, and none of such parties make any representation regarding the advisability of purchasing EquiTrust index annuities nor do they have any liability for any errors, omissions, or interruptions of the S&P 500®.

Index annuities are not stock-market investments and do not directly participate in any equity investments. The market index does not include dividends paid on underlying stocks, and therefore does not reflect the total return of underlying stocks. Purchases of an index annuity are not direct investments in the S&P 500® Index. Withdrawals from an index annuity may be subject to surrender charges.

This index strategy is issued on form series ICC11-ET-1MC(11-11) and is included with annuity form series ET-MPP-2000(02-05), ET-MPP-2000(02-05) with rider ET-AVBR(06-09) , ET-MTB-2000(06-07), ET-MKB-2000(07-05), ICC12-ET-EIA-2000(01-12) and ICC11-ET-STS-2000(11-11); ET-MPP-2000C(01-07), ET-MPP-2000C(01-07) with rider ET-AVBRC(06-09), ET-MTB-2000C(06-07), ET-MKB-2000C(01-07) and ET-EIA-2000C(01-07). Guarantees expressed are based on the claims-paying ability of EquiTrust Life Insurance Company. Products not available in all states.